Cement Industry in Bangladesh: Full Overview

Cement is an essential construction material used globally, and almost all modern structures require cement. Cement is the second most utilized product globally, falling behind in potable/drinking water. It is produced from processing limestone and other materials in manufacturing plants. Cement is processed further to make concrete, an integral part of stable structures like roads, schools, airports, hospitals, houses, water supply systems, dams, etc. Global cement consumption has reached almost 4 billion tons a year. It plays a crucial role in the economy due to its sophisticated supply chain. The cement industry created more than 8% of jobs globally and around 5.5% of global GDP.

Source: Fortune Business Insights

Cement usage is increasing in developing countries like Bangladesh. The cement industry in Bangladesh is the 40th largest market in the world. The Bangladesh government has undertaken numerous megaprojects that require massive cement to build. The cement industry in Bangladesh has played a crucial role in developing infrastructure as the economy has been growing over the years. The magnitude of cement demand is an important metric that reveals how a country progresses toward development and directly influences the economy. This data also shows the economic solvency of residents as urbanization expands throughout the country. Even though Bangladesh does not have a long history with cement production, the industry has quickly grown to an enormous scale. From importing cement to exporting, the story of the cement industry in Bangladesh is a promising one.

History of the Cement Industry in Bangladesh

The construction industry is highly dependent on the production of cement. The manufacturing process of cement is highly energy-intensive. It involves procuring limestone, shell, and clay. The primary raw material is limestone which is only available in specific locations. Bangladesh imports raw materials from other countries to produce cement. The raw materials are crushed and heated at temperatures over a thousand degrees Celsius to generate clinkers. After this step, clinkers are mixed with gypsum and grounded to a fine powder. It is a highly sophisticated process that involves a complex supply chain. The demand for cement depends on the urbanization rate and many ongoing development projects in the country.

Bangladesh does not have a deep-rooted legacy of construction materials like other countries. The first cement factory was established in 1941, under the name “Chattak Cement Factory Ltd” (formerly called Assam Bengal Cement Company Ltd) in Sylhet, a north-eastern part of the country, during the administration of British India. After the liberation of Bangladesh, “Chittagong Cement Clinker and Grinding Factory Ltd” (Currently owned by Heidelberg Cement) were established in 1973 in Chittagong. The demand for cement quickly rose in Bangladesh as it was trying to build structures to facilitate the newly born country. Roads, schools, hospitals, and bridges required a massive amount of cement. Even though the demand was rising, no other cement factories were established until the early 1990s. The need for adhesive was only met by importing cement from neighboring countries like Indonesia, China, Malaysia, and India. One of the primary reasons investors were not investing in the cement industry in Bangladesh was that Bangladesh lacks limestone, the primary raw material in cement production. Nevertheless, the enthusiasm of some entrepreneurs in the early 1990s paved the way for strengthening the cement industry in Bangladesh.

In the 1990s, many cement manufacturers entered the market like Confidence Cement Ltd, Meghna Cement Mills Ltd of Bashundhara Group, Diamond Cement Limited, etc. During the 2000s, many small, medium, and big companies started entering the industry, including Mir Cement Ltd of Mir Group of Companies Ltd, Unique Cement Industries Ltd of Meghna Group of Industry, and Premier Cement Ltd Heidelberg Cement Bangladesh Ltd, etc. There are many local producers and multinational companies engaged in contributing to the cement industry in Bangladesh.

Source: BCMA

Overview of the Cement Industry in Bangladesh

The consumption of cement in Bangladesh has increased rapidly during the last decade, thanks to an upswing in the number of mega projects undertaken by governments, urbanization, and the flourishing real estate business across the country. According to a report published by the Bangladesh Cement Manufacturers Association (BCMA), cement sales soared to new heights of 33 million tonnes in 2018, up from 29 million tonnes in 2017. The increase was a record-breaking 12%. The cement industry in Bangladesh is also one of the fastest-growing cement markets globally, registering a CAGR of almost 11.5% over the last decade. Per capita, cement consumption was only 95 KG in 2011. As of 2018, per capita, cement consumption has reached 187 KG. However, Bangladesh remains one of the lowest consumers of cement in the world.

Bangladesh needs to import all the materials required for cement production from different countries. The raw material price increased significantly in the last 6 – 7 years. Despite the challenges, Bangladesh declared a 15.5% growth in 2018. Bangladesh exported cement valued at the US $12.6 million during the FY17-18. The export amount also grew more than 15% compared to the previous year. Bangladesh’s leading destination for exporting cement in India.

Bangladesh showed excellent resilience and promise in the cement industry. The country used to make up its demand for cement only through import until the first half 1990s, accounting for more than 95%. As local industries started emerging in the country, dependency on imports drastically reduced over the years. In 2003, Bangladesh exported cement for the very first time. Currently, Bangladesh exports cement to India, Nepal, Myanmar, Maldives, and Sri Lanka. The largest multinational cement companies operating in Bangladesh are Heidelberg Cement Ltd and LafargeHolcim Ltd. Many local companies produce high-standard cement as well.

Source: EBL Securities

Per Capita Cement Consumption in Bangladesh

As of 2018, per capita, cement consumption has stood at 187 KG, almost double the value of 2011, which reported only 95 KG. Despite the spectacular growth, Bangladesh remains one of the lowest cement consumers globally. Ongoing megaprojects are pushing the growth, but delayed implementation and mismanagement is restraining the cement industry in Bangladesh from gaining its full potential.

The Cement Industry in Bangladesh is Getting Concentrated

The top ten cement producers in Bangladesh meet 81% of the total demand. Among the ten companies, two are multinational, and the rest are local manufacturers. Multinational cement producers face intense competition from local cement producers. They have more robust brand communication with customers, superior product quality at a lower price, and better marketing tactics.

This scenario looked very different even a decade ago. Multinational companies used to occupy the larger share of the cement industry in Bangladesh. The system changed quickly as local producers emerged and showed their competence with superior cement quality at a cheaper price point. Two multinational cement companies, UAE-based Emirates Cement and Mexico-based cement manufacturer Cemex ceased their operations in 2016 in Bangladesh due to intense competition from local cement producers.

Source: New Vision

The Cement Industry in Bangladesh is Expanding their Production Speculating Future Growth

During the last few years, cement producers have gradually increased their production rate, anticipating future demand. Bangladesh has shown extraordinary economic growth compared to neighboring countries. Financial solvency, rapid urbanization, and various mega projects undertaken by the government have made cement producers confident about the industry’s future. However, overcapacity exists in the market. But market demand is almost equal to the adequate capacity during peak seasons. Total cement production reached above 65 million tons in 2019. Nevertheless, the effective capacity is lower due to power interruption, outages, and other obstacles.

Source: Cement Equipment

Price Hike Due to Increased Cost of Raw Materials and Transportation

Bangladesh imports necessary raw materials for cement production from various countries. Raw materials include clinker, slag, fly ash, gypsum, and limestone. These are mainly imported from Vietnam. The Chinese government started discouraging clinker production in late 2017, responsible for harmful environmental impacts. So, the primary source of import destination was Vietnam for China. Accounting for the sudden spike in demand, the clinker price rose by almost $10 per ton at the beginning of 2018. Accordingly, cement manufacturers were forced to raise their prices in Bangladesh as production costs increased. Cement production cost is highly dependent on the price of raw materials. Cement manufacturers’ profitability is highly dependent on the price of raw materials and transportation costs.

Bangladesh is self-sufficient in cement production, but the country must import almost all the raw materials required for cement production. Bangladesh has a shortage of essential mineral resources like limestone, the primary material for cement production. So, almost all manufacturers must import raw materials like clinkers, gypsum, fly ash, and iron slag from neighboring countries.

The Bangladesh government increased gas prices many times over the years. So, manufacturers with gas-based captive power plants faced direct impacts due to gas price hikes. The cement industry in Bangladesh faced terrible outcomes as BCMA predicted such an increase in gas price can negatively impact the industry’s growth.

Freight costs have also increased due to higher fuel and charter costs. Furthermore, weight restrictions on highways imposed by the government, liquidity crisis, and higher transportation costs aided in the increased cement price in Bangladesh.

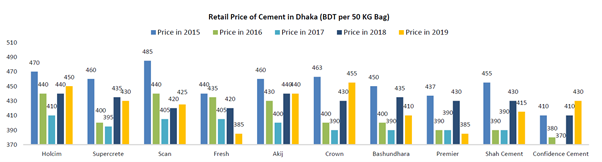

However, due to intense rivalry between local manufacturers, there is minimal scope for manufacturers to increase their prices by a large margin. Different brands of cement tackled the situation differently over the years. The following chart presents a comparative price analysis of cement in Bangladesh.

Source: EBL Securities

Technological Advancement Can Create a Paradigm Shift

The cement industry in Bangladesh is on the verge of a revolutionary change. Big cement producers have started implementing Vertical Roller Mill VRM, and it is recognized globally and certified as one of the advanced cement production tools. VRM guarantees high fineness, better Particle Size Distribution, faster setting time, and less energy consumption. This tool also helps producers to make slag cement. Portland Composite Cement is gaining popularity in many places, and VRM technology plays a crucial role in producing PCC.

Seasonality in Demand

The cement industry in Bangladesh faces seasonality as the demand spikes in the winter season. Many construction projects start during the winter season, thus the higher demand. The peak season for cement consumption is from November to April/May, and the off-season is from June to October (depending on the monsoon).

Market demand sometimes exceeds adequate capacity during peak seasons. More than 60% of the cement consumption in Bangladesh occurs during the winter season. Seasonality in demand can sometimes hamper the overall productivity of the industry. However, the cement industry in Bangladesh is heading toward a steady demand trajectory as various government megaprojects are ongoing.

Public Sector Cement Consumption is Increasing Due to Various Megaprojects

Cement consumption in Bangladesh can primarily be grouped into two distinct categories: The public sector and the Private sector. A few years back, the biggest consumers of cement were individual consumers who purchased glue for their housing needs, along with the real estate and developer business. However, the government has taken many megaprojects, which now contribute to the highest cement consumption in Bangladesh. The public sector now consumes about 45% of the cement produced in Bangladesh.

There are many ongoing and proposed megaprojects in Bangladesh. These include Padma Multipurpose Bridge, Dhaka Metro Rail, Padma Rail Link, Matarbari Deep Sea Port, Hazrat Shahjalal International Airport Terminal 3, Dhaka Elevated Expressway, Rooppur Nuclear Power Plant, Dhaka to Chittagong Express Railway, Karnaphuli Tunnel, and Bangabandhu Railway Bridge Project.

Cement consumption is geographically concentrated in Bangladesh. Dhaka and Chittagong consume almost 75% of the cement. The rural economy has contributed very little to this industry up until now. However, the scenario is changing very swiftly as the economic growth has expanded all over the country. Cement consumption is increasing rapidly in rural areas. Cement demand has improved dramatically in northern, western, and southern parts of Bangladesh. Poor transportation in remote parts of the country hampers cement transportation as cement quality diminishes quickly with time.

Source: Business Inspection

Export Scenario of the Industry

Bangladesh first started exporting cement in 2003. Currently, Bangladesh exports cement to India, Myanmar, Nepal, Maldives, and Sri Lanka. During the FY17-18, Bangladesh exported approximately $12.6 million worth of cement compared to $10.8 million in the year before. This shows the staggering growth of the cement industry in Bangladesh, reporting a 16.6% improvement. However, the pandemic disrupted the export situation in the industry, but the sector aims to grow by a superior margin in the upcoming years.

Source: CEMNET

The Global Cement Industry

More than 1000 cement producers operate globally with over 2400 integrated cement plants. The top five countries are responsible for more than 75% of the global cement production. China leads this market with more than 50% of the share. However, the global demand for cement has reduced over the last decade as China’s cement consumption declined over the years. But the market is still up-and-coming in the southern Asia region as most countries are developing rapidly.

The global cement market was estimated at $313.60 billion in 2020. Due to the Covid-19 pandemic, the world economy suffered terribly, and its deep-rooted impact was imprinted on the cement industry. Negative demand amid the pandemic disrupted the global cement industry. The sector witnessed a massive decline of 3.6% in 2020 compared to the average year-on-year growth during the 2017 – 2020 period.

Source: Global Cement

The Pandemic’s Impact on the Cement Industry in Bangladesh

Bangladesh’s cement market suffered the same fate along with the global cement industry. As lockdown protocols started to show in March 2020, almost all construction projects were at a standstill. Cement consumption almost came down to zero as all manufacturing plants in the industry were shut down to maintain the safety of the workers. The sector suffered huge losses during this period.

From the beginning of 2021, cement production in Bangladesh started to become normal again. The industry showed a significant comeback as the economy reopened. The silver lining for the industry is its BDT 30,000 crore working capital loan package to fight against the potential fallout of the Covid-19 crisis. The government also allowed a subsidized 4.5% interest rate. The cement industry in Bangladesh showed its resilience against the turning tides and offered big promises for the future.

Source: The Business Standard

Summary

Bangladesh’s economy is growing at a very fast rate and the activity of the government, private, and commercial construction is increasing gradually. Increasing construction works will naturally increase the demand for cement in the country. Furthermore, there is a huge potential for the industry in export. Bangladeshi cement is gaining a reputation in India due to its cheaper shipping cost, good quality, and competitive pricing strategy. Even if Bangladeshi cement manufacturers cannot export to distant countries, there is a huge potential in Northeast India or the Seven Sister States. So, the cement industry in Bangladesh has a promising future ahead despite some challenges it is currently facing.

Mir Cement is renowned for its excellent mixture of the best cement ingredients: clinker, slag, limestone, gypsum, and fly ash. The types of cement are produced using the finest quality of raw materials and state-of-the-art technology. The company is also making a significant contribution to the cement industry in Bangladesh.

Frequently Asked Questions (FAQs)

How many cement manufacturers are in Bangladesh?

Ans: There is 37 active cement companies in Bangladesh, and four are multinational companies among them.

Which sector consumes cement the most currently in Bangladesh?

Ans: Currently, the public sector consumes the most cement in Bangladesh.

What is the price of cement bags in Bangladesh?

Ans: The average price range for a bag of 50KG is from 400 TK to 550 TK. To know more, please check out the latest market price.

What is the shelf life of cement produced in Bangladesh?

Ans: The shelf life of cement is three months from the manufacturing date.

Does Bangladesh import cement?

Ans: Bangladesh imports raw materials necessary for producing cement.